Photo by Fabian Blank on Unsplash

Back in 2010 I had a healthy house deposit sitting in a bank; at 38 I was very late to the home ownership party.

Then, LIFE. I got chronically ill, was forced to walk away from my corporate business and for the best part of two years didn't earn a cent. So it was that my savings disappeared and a few years later I found myself starting again.

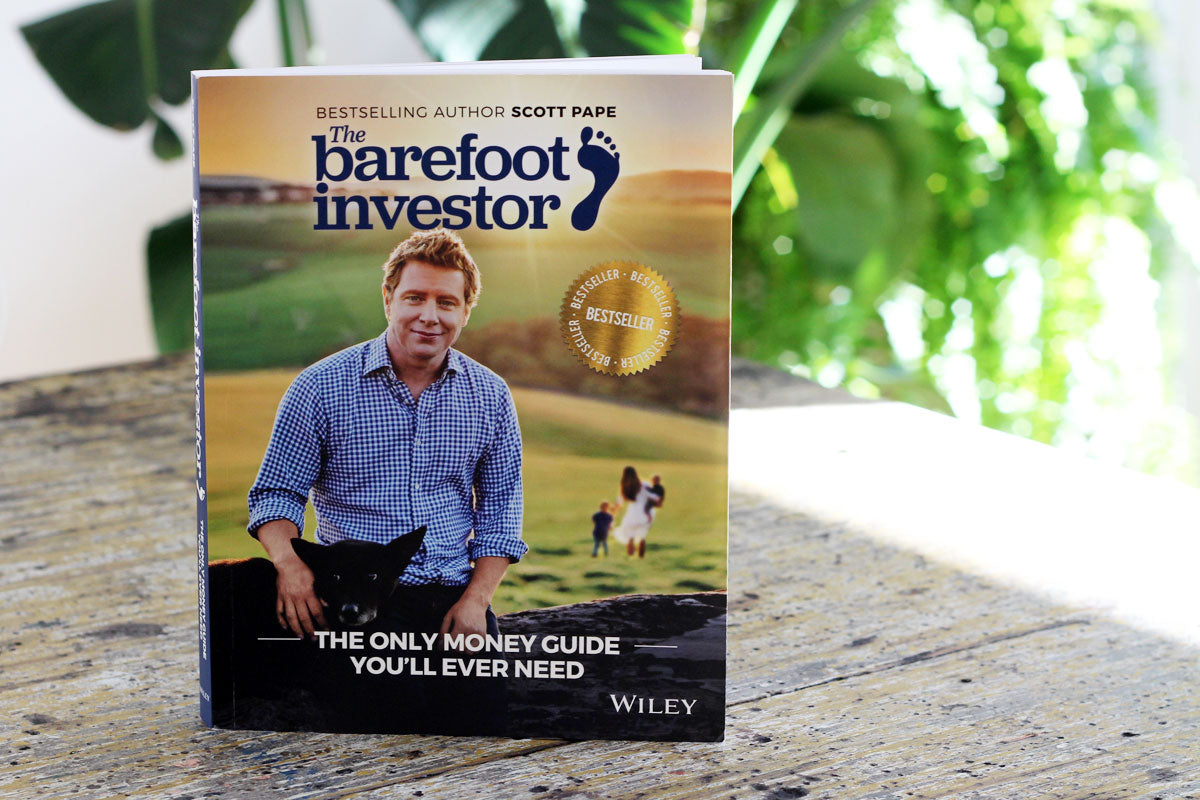

In March 2018, on the advice of a dear friend, I picked up a copy of The Barefoot Investor at an airport. As I handed over my credit card (money on loan, let's not forget that), the shop attendant proceeded to say that he had never seen more copies of a book walk off the shelves, and that my life was about to change. I had a sense he was right.

On a flight from Sydney to Melbourne I devoured most of that book. I'm not sure what came over me during those pages but the author (Scott Pape) sure has a way with words. I tell you, I got off that plane a changed and highly determined woman.

That day I made a critical decision. I decided it was time to set my heart and mind free from the worries of 'what-ifs' in life. I decided that for the sake of my health in general, it was time to make my financial health a priority.

I got off that plane, arrived home and cut up my credit cards.

It felt like the most liberating and bravest thing I've ever done. It also felt immensely scary.

How is it that we have become to feel financially 'secure' with credit cards, money that isn't even our own?

"Oh but I need the security!" a friend told me recently, when I encouraged her to read the book. What the? It's not your money, that ain't security!

Many of us here put much thought and care into managing our mental, emotional and physical health. How many of us are putting similar thought into our financial health, a matter that has far-reaching implications for how we live our lives? Our financial health (or lack thereof) can create more dread, more misery, more strain than we care to admit.

Am I wrong?

Trusting as I seem to do in an 'expert' (Scott is, just read the testimonials in his book) I followed his lead to a T. Sacking Westpac and their hefty fees (is it weird that I felt just a little sadness about the break-up of a thirty year relationship?), I established my 4 online bank accounts with a fee free bank: Daily Expenses, Smile, Splurge and Fire Extinguisher. I set up another savings account with an entirely different online bank and called that one Mojo. (Many of you reading this will be well versed with these.) Then, I got to distributing my monthly earnings (setting up your 'buckets' as Scott tells us devotees to do).

Whilst there's a long way to go before I'll be chasing chooks on my hobby farm, I feel a darn site closer to the goal than I did even a month ago. You see now I have a sense of security because I actually know what I have and what I don't, and only spend what I have.

I've finally become a conscious spender.

If you've been sitting on the fence, if you find yourself avoiding the topic of money altogether because it's so darn scary, I urge you to read the comments I received on my Instagram account. People from all over Australia - single mums, divorcees, teenagers, others like me, starting from nothing.. so many stories of women whose lives have taken a turn they could never have foreseen, had they not read this book.

How much money you have isn't as critical as what you DO with it. It's what you do with it that determines whether you'll ever experience financial freedom in your lifetime and whether you'll ever be free from the stress it creates for so many.

So what's stopping you? Fear? A feeling of it being all too late so you're instead burying your head in the sand? Limiting beliefs and abundance blocks telling you you're not worthy of financial freedom? An old story playing over and over and over in your head? If thousands and thousands (and thousands) of Australians can regain control, so can you.

Go buy this book, or borrow it from a friend. Read it. Quite possibly it'll be one of the best decisions you'll make too.

Side notes: Scott Pape has not asked me to write this, nor have we ever spoken. But far out I'd love an hour or two of his time!

Already read it? Oh how I'd love to hear from fellow BFI's! Tell me, how has it changed your life and the life of your family? Have you a story to share to help inspire our community members?